SVB – A Guest Post by Francis Turner

As anyone paying attention to the news knows, SVB went titsup.com at the end of last week after it was hit by an absolute classic bank run. Err Ooops. The big question now is whether the US government / regulators can stop other banks also failing too. Based on some things I’ve found I’m not sure they can do it with what they have announced now, though they may be able to correct that.

There are various reasons for this failure but I believe that two key ones are (US) government actions (and inactions) and right on wokeness. The wokeness almost certainly meant that SVBs management was filled with diversity hires rather than nerds who could figure out that critical assumptions were no longer true, but the critical assumptions changing was entirely caused by government and in particular by the covidiocy. It also did not help that US regulators, thanks to lobbying from SVB and pals, did not make it, the 16th largest bank in the US, comply with many of the regulations put in place by the Basel III agreements in response to the 2008 financial collapse (archive: https://archive.md/hrQ7p ) but for the most part SVB did what it was expected to do (including all the DIE wokeness stuff) so that’s not necessarily a cause of the failure.

The wokeness link above shows the wokeness and virtue signalling side of the problem (and notes that the C-suite was distinctly white and male so the wokeness only went so far) so I’m not going to go into that area. Plus it is of course hard to prove that some black lesbian middle manager in the risk department and xer excitingly genderfluid and racially diverse colleagues were not smart enough to read the tea-leaves earlier though one suspects that this is likely to have been the case.

The government caused it

From 2008 until a year or two ago government borrowing was at interest rates that were under 1%. This was even true for long term bonds, although really longer term bonds (30 year treasuries) were up at a massive 2% yield.

As eny fule kno, the wuflu led to the US (and other world) governments printing lots and lots of money and the US government balanced its books in part by borrowing enormous sums of money and issuing medium and long term bonds at these very low interest rates.

The money that the government distributed to businesses was supposed to help them keep the lights on and employees paid even as they worked from home, failed to have customers etc. etc. but a large chunk of it ended up in other places. Some of this was straight up fraud but quite a lot more was more nuanced. It was businesses claiming more money than they really needed because it was basically free and the rules were pretty loose. Lots of small businesses applied for grants and got them and banked much of the money because they didn’t need to spend it all at the time. Lots more went in various ways to VCs and the like to fund new startups and small businesses. SVB ended up being the banker for a lot of that money. So much so that SVB more or less tripled in size from $61B of deposits in 2019 to $189B by the end of 2021. It looks like SVB basically got about 5% of all US Wuflu subsidy spending deposited in it in 2020 and 2021.

The problem for SVB was that it had ~$120B of new money. It had no way to invest all of it in its traditional business, basically lending to tech companies mainly to handle short term cash flow bumps and the like, because it was massively too much money.

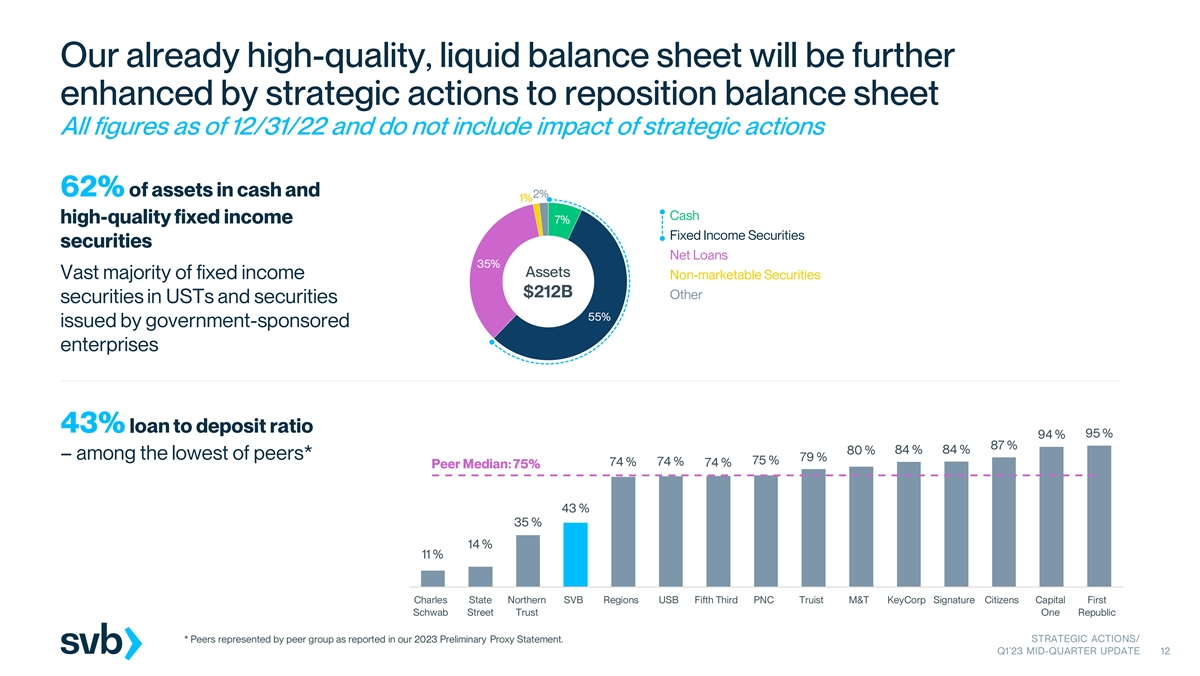

Well banks get dinged for not working the money they have on deposit by investors and by regulators and so it had to invest all this moolah in something and do so fairly quickly. In addition to various wokey greeny things which were almost certainly poor investments and not very liquid, it bought what seemed like safe and fairly liquid assets, so-called fixed income securities – treasury bonds of various maturities and mortgage backed securities (MBS). In the low inflationary, low interest environment of the 2010s this would have been a fine decision. Sure those treasuries and MBSs paid a fairly low 1-2% or so interest, but they were considered safe because the underlying assets were stable in value – increasing in terms of the property backing the MBSs even – and they were reasonably liquid so you could unload them quickly if need be and not face much of a loss, if any, when doing so. By the end of 2022 SVB had about $115B in these fixed income securities (essentially almost all of the money it had taken in since 2019)

Unfortunately it bought most those assets in 2020, 2021 and early 2022 when interest rates were still in the 1% range but that was about to change. As we know in 2021 inflation started to kick off because of all the loose covidiocy money and a year ago the Federal Reserve started to raise interest rates to try and stop the inflation rate staying high. This abrupt rise in rates from 0.25% in early 2022 to 4.5% now in 2023 has had a number of entirely predictable effects. One effect was that the 1-2% yield securities that SVB had bought declined significantly in value leading SVB (and probably many other financial institutions) to have large unrealized losses. In itself that was not a disaster since if they were held for long enough there was a decent chance that those losses would be recouped as prices increased again.

Unfortunately at the same time the market for IPOs and PE sales of startups collapsed and a significant number of startups found that their product or service was not required by people who now had higher living expenses and the same pay check. This meant that SVB’s depositors were steadily taking money out without there being new deposits paid back in. In other words the $120B windfall of deposits was gradually being withdrawn and SVB needed to gradually sell its investment assets so as to cover the withdrawals.

In theory (and indeed according to financial regulations) all SVB needed to do was sell some of its bonds and MBSs so as to reduce its assets as it paid out its depositors. Except that, as noted earlier, those assets it had were now worth significantly less than all the liabilities (deposits) it would need to repay. Moreover enough of the people who had accounts there and/or running/advising corporations with accounts there could take a look at the SVB financial statements and realize that there were these problems and so decided to withdraw more of their money. Eventually almost everyone wanted their money out and there really was no way for SVB to unload tens of billions of dollars of fixed income assets without suffering enormous losses in addition to the ones it had already booked. That was what the emergency sale of $21 billion of bonds at a (further) loss of $1.8 billion showed. Even the proceeds of that sale ($21B ) plus the cash on hand ($14B) was not enough to repay all the depositors trying to withdraw their money.

The nitty gritty details

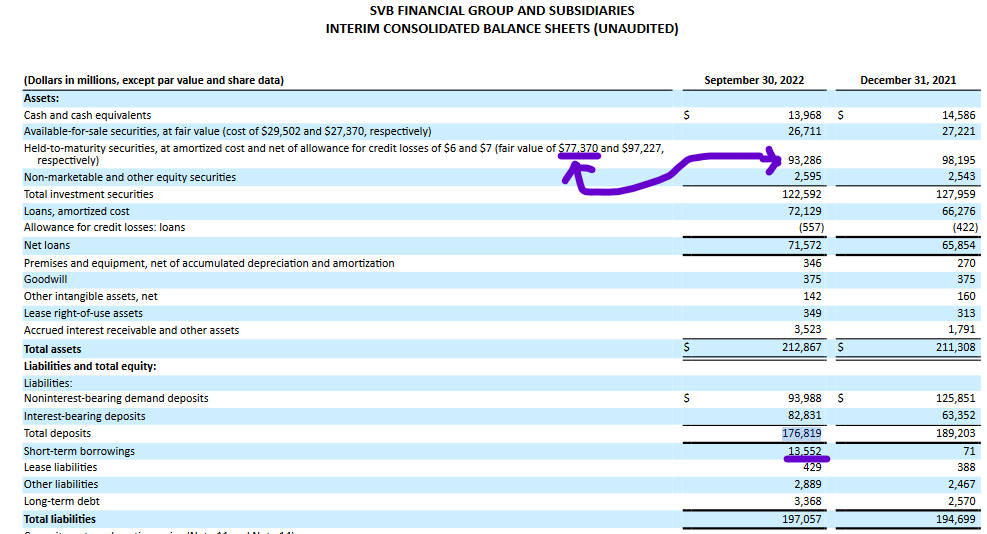

If you take a look at the image above it shows that going into 2023 SVB had about $14B in cash. That’s not unreasonable as it is somewhere between 5% and 10% of total deposits and about the same as in the past. And if the FI assets were actually sellable at around the price paid things would be fine even as deposits decreased. The Q4 10Q filed in November 2022 shows roughly $14B in cash and $177B in deposits at the end of September 2022, down from $14.5B and $189B at end of December 2021.

The decline in deposits (liabilities) in the 10K is noteworthy in that it is on the order of $1.4B/month and assuming that continued at roughly the same rate it would imply that deposits at the start of March 2023 would be around 170B, perhaps a fraction lower. Given the $14B cash on hand in December that is also not bad, if that were the only need for the cash. Unfortunately the 10k shows two other problems. One is a line of “Short-term borrowings” which stood at $13.5B at the end of September 2022 up from a trivial $71M at the start of the year. I can see no note about when that is due to be repaid but “short-term” usually means a year or so at most. Almost certainly this is related to the unrealized losses in the AFS (Available for sale) and HTM (Hold to maturity) assets and, as things developed after September 2022 those numbers almost certainly got worse.

Even at the start of 2022 there were losses in both but the total unrealized losses was something like $1B or less than 1% of the $120B+ total and that sort of loss would normally be easily covered by profits elsewhere. However by September the losses in HTM had ballooned to $16B (out of $93B total) and in AFS they were just under $3B out of $29.5B total. For those struggling to do the sums at home this is comfortably over 15% of the FI portfolio and more than 10% of the total deposit liabilities. One must assume than in the months since September those losses increased substantially. One thing that does stand out is that the bonds were all in the AFS pile and marked to market (i.e. the ~10% haircut from purchase price to sale value in Sept 2022 was already there), while all the MBSs were in the HTM pile.

This is why SVB sold $21 billion of bonds at an additional loss of $1.8 billion – probably this was almost everything in the AFS pile – and why that was nowhere near enough to stop people demanding their money. Note that the book value of that AFS bonds was actually almost $30B so the $1.8B loss was in addition to prior markdowns to around $23-24B, in all SVB probably sold those bonds for 70% of what it paid for them. SVB still has an enormous mismatch between cost and fair market value of its (AFS and) HTM assets and that mismatch (on the order of $20B or more) is way more than the intended ~$2B share offering.

So what did SVB do wrong?

That, as they say is a good question. This article points out that SVB were basically good boys and girls who did not bet the farm on risky things like cryptocurrencies and I agree with it.

Mostly they trusted the government and did what the government (and regulators) told them to do without doing the work to figure out if this was sensible in the longer term (though they probably also lobbied to evade regulations that would cost them profits such as the Basel III ones). That was fatal because covidiocy showed in numerous ways that the government is not smart enough to figure this sort of thing out and in fact will do things that break other parts of the system because the government’s “top men” are not in fact top (and probably not men).

It is however very hard to figure out where SVB should have put their unexpected load of new deposits. $120B is a very large amount of money to invest and fixed income securities were good, recommended even, investment choices that were perceived to be low risk. Short of saying “we don’t want your money” there seems no way that SVB would not have entered 2022 with a large holding of fixed income securities. It is even harder to figure out where and when they should have moved it out into something else once it became clear that inflation was a thing and that higher interest rates were going to come shortly afterwards. I can imagine them being extremely unpopular with the government if they had started selling their MBSs and bonds in early 2022 and even if they did, it is unclear what they would have invested in instead (banks like Silvergate did invest in crypto and hit other problems).

Will the Bailout work?

We’re going to see more of this as the government bails SVB and other banks out. Note that the imbalance between FI assets and liabilities is almost certainly not even remotely unique to SVB. I’ve seen mention that there are $600B of longer maturity bonds that are underwater (lost the link) and I imagine there’s a similar if not larger amount of underwater MBSs. That latter may be even more of a threat since if property prices drop again as in 2008 then the prospect of these MBSs being bad debts grows further depressing the asset price. So far I haven’t seen too much sign of people defaulting on residential mortgages. But, given the way the wuflu has led to much more working from home, office occupancy rates are way down and unlikely to recover for a while if ever. Since companies will be leasing less space the owners of now much emptier office buildings are going to struggle to repay the loans they took out to build them. Defaults on commercial property loans therefore seem quite likely.

The government (treasury, federal reserve, SEC etc.) have announced that they will redeem government securities at par value thus removing the losses caused by their 20% or so fall in value over the last year. This appears relatively generous, but if done right (as the UK Bank of England did last autumn) it should stabilize the market without the government actually needing to buy all the securities it says it is willing to. Moreover the government can make a profit by selling the stuff again later, which is something that the BOE also did AIUI.

However I’m not sure how this would actually help SVB. As I noted above in my perusal of the 10Q almost all the long dated treasuries were in the AFS pile and had already had their loss mostly booked while what was in the HTM pile was almost all MBS (about $85B bought, valued at $71B in September and probably less now). SVB simply doesn’t have more bonds to sell to the government. The question is how many other banks are more heavily exposed to under water MBSs rather than under water government bonds?

If depositors believe that the money they have in bank accounts is safe enough because enough of the bank’s investment assets are government backed then those banks will likely survive. But I imagine many depositors are going to be looking at recent 10Qs to see if they can see large unrealized losses and particularly large losses in MBSs. As we saw at SVB it only needs 10% or so of a bank’s deposits to be withdrawn in a short period of time for the bank to need to sell assets. If it then starts having to report losses and more losses the withdrawals will pick up pace and shortly we have another bank run.

My expectation is that we may see a few more banks in trouble but probably not the sort of widespread issues we saw in 2008

Thank you Francis Turner for the clear explanation of a complex subject.

Seconded; a good summary as far as I can tell. It’s all a bit esoteric, but then, what controlled by government regs isn’t? 😦

One of the more interesting things about SVB that I didn’t put in the post is that so many technology companies had stuck a LOT of money into simple deposit/savings/checking accounts at SVB rather than investing it. I;m not quite clear why they were so conservative but it certainly contributed to the run because these customers didn’t have any other money outside of their SVB accounts

If I were a tech company I’d certainly have accounts with multiple banks simply to lessen the likelihood of a catastrophic loss of funds if one bank went titsup.com

I imagine a lot are also now (re)learning how to read financial reports and using that to decide where they want to deposit their funds in the future

When VCs (venture capitalists) fund a startup, they want to make sure they know the financial position of the startup at all times. In Silicon Valley, it is (was?) common for the funding documents to require that all cash-in-hand was on deposit at SVB specifically. The VCs had back-channels into SVB (because they were SVB’s customers, too) so that they could monitor the money very closely. This was useful in preventing various sorts of chicanery by the new, untried, possibly untrustworthy management of the startup. These arrangements evolved from a series of hard lessons learned decades ago. All very reasonable, actually — until the bank itself went TU.

Startups are new and often understaffed, and lack the long term streetwise of older firms.

And a lot of them are started by techies who are focused on the tech, and don’t even really consider the basic elements of a business. Add to that “lottery winner syndrome” from being handed more money than they’ve ever seen or even thought about…..

I found the 2022 10K (annual filing) https://d18rn0p25nwr6d.cloudfront.net/CIK-0000719739/e0b8bb11-3b21-4348-826f-7370b93d5b5c.html

Don’t know how I missed that over the weekend

Also one o the sources for the $600B+ of treasury losses is https://www.sovereignman.com/trends/if-svb-is-insolvent-so-is-everyone-else-146244/

The guy misses the fact that SVB had 3x as many MBS as Treasuries thought

Nice overview, thanks, Francis.

My fear is of the Feds printing even more money to cover those losses; furthering inflation and devaluation of the dollar.

Very well done. Thanks!

The Reader appreciates the clear explanation. Thanks!

Thank you. This makes a lot more sense than the breathless silliness in most media. I’m a little puzzled why things like Zions Bank and other regionals got zapped, unless it’s the concern that they did something similar with buying Federal bonds and securities to hold that “excess” COVID money.

One caveat about dividing money up among multiple accounts at multiple banks – let your heirs/executor know, and have a way for them to sort all that out relatively painlessly. A friend of the family had to deal with eight banks and multiple accounts after her husband died. It was painful to watch, since he’d not told her about some “since they were for the ranch.” That still came under probate.

I’ve noticed that everyone I know who is in a position to know what they are talking about consistently gives the anticlimactic version of events and predictions.

Presstitutes are in the panic business. They do not want you calm and contemplative. They want you tweaking like a methhead in withdrawl.

Absolutely true.

And it’s as true of the places you trust as it is of the leftoid garbage fires and the legacy press. They don’t get eyeballs and $$ by helping you remain rational and calm.

If you’re not paying for something, you’re the product..

One VITAL task is to properly designate beneficiaries for every financial account or insurance policy. If that is done transfers are easy. If not, it can be a real process..

My wife is executor for an estate where the deceased did not do that, it took a long time to get access to a couple of investment accounts, even after providing certified copies of the death certificate and will making her executor. It finally took a court order for T Rowe Price to cough up the money.

“Once you have their money, never give it back.”

You keep 100% of the extra proceeds of a stall. Thus why many businesses are habitually late paying invoices. They don’t usually admit it, but their “process” often takes 25 or 55 days, coincidently of course.

Ahem. “T. Rowe Price”

We had the misfortune of dealing with them, too.

Contagion. They got caught up in the panic. That’s what a panic is

People who panic will seldom admit it.

With respect to the regional banks, one of the explanations I’ve seen was people moving funds from a bank “not too big to fail” to a TBTF one, like JPM.

Late BIL left one chunk of money for his son, but figuring out where the rest of the assets were has been a whole lot of pain for the executor. It hasn’t helped that he could have been a featured client on one of the hoarder shows, though it wasn’t for lack of money. Sigh.

Beyond that, it’s still miserable. (His and $SPOUSE’s kid sister got the executor task, made more complicated because reasons.) I gather that Silicon Valley also has major homeless issues, and seems to be following San Fran’s shining example of doing everything wrong.

“a bank “not too big to fail” to a TBTF one, like JPM.”

Yeah, and when JPMC offered First Republic 70 billion in liquidity guarantees, that looks like the first step in a merger.

Drawing our wills up, my wife wanted her sister and her brother to be executors. Both live over a thousand miles away, and can’t just take off work for however long it takes to deal with things if we die together. It took years before she finally relented and we could move forward on that.

Thank you for that explanation. This answers a lot of questions I had about the SVB failure, and about what may be coming next.

It sure didn’t help the folks running the place were the type to unwaveringly rely on the Feds being right all the time.

If you look at this article, you’ll see that’s because they WERE the Feds.

https://twitchy.com/samj-3930/2023/03/13/paul-sperry-reports-developing-story-on-startling-connection-between-janet-yellen-and-svbcollapse/

Links in the article, one to Paul Sperry on the DIE director and one to Reuters about the CEO being on the SF Fed board..

I’d seen the tangled mass that was that board, and the other with Barney Frank on the board.

I’m reminded of the knob appointed by 0bama, who was told “We can’t do this, this violates the laws of physics.” and replied “We hold both houses right now, we can change the laws!”

Same magical thinking that, because Milton Friedman is dead, stupid fiscal policy will suddenly start working for a change.

“I will MAKE it legal.”

If no one may contradict Lysenko, his ideas will triumph, finally.

Credit Suisse is also running into problems: https://www.barrons.com/news/embattled-credit-suisse-admits-material-weaknesses-3332699f?refsec=topics_afp-news

“The material weaknesses that have been identified relate to the failure to design and maintain an effective risk assessment process to identify and analyse the risk of material misstatements in its financial statements,” the report said.

I saw a meme the other day; back in the sixties the minimum wage was five 90% silver quarters, today the silver in those 5 quarters is worth over twenty two dollars.

Why this bank run? In government we trust.

Queen Elizabeth I seldom gets proper credit for saving the British money system.

Her father, Henry VIII debased their currency badly, much as he debased other things. Elizabeth had all the “no one wants this crap” debased coin melted down and recast clean. As a result, their coin was again valued and sought.

Bad money always displaces good, absent heroic efforts to remove the bad.

Maybe…we could melt down all the bad bureaucrats and politicians and recast them? 😛

Whats the point? Most of them are so darn stringy they wouldn’t even make decent soap.

Would they be any more useless than they are now?

F. Paul Wilson used that quote. He was a fairly extreme Libertarian, but that doesn’t mean his observations were incorrect.

I knew there was a “law” about that. I looked it up: Gresham’s Law.

What I keep wondering, and yes, maybe it was there but ox slow, is…. is this a single blown fuse or popped breaker… OR.. is this one line failing and dumping the load the on the remaining lines, so the next overloads, etc. ala November 9, 1965 in the northeast.

I disagree somewhat with the author…To simplify matters a bit, SVB had a mismatch between longer term investments at historically low interest rates and very short term potential liabilities with its depositors..When interest rates began to increase towards historically normal levels, due in part to Fed policy, SVB should have liquidated its long term portfolio and gone short term with 3 or 6 month Treasury notes….That would have been prudent, and SVB was not prudent…I also wonder how much of its loan portfolio is to very shaky startups, 90% of which fail….In short, it’s just a repeat of 900 years of banks gambling with depositors’ money, then running to the Government when they lose…

Yep.

I agree they should have liquidated everything in early 2022. BUT if they had dumped ~$120B of longer term securities on the market

a) they would have sold as a considerable loss anyway

b) they would have panicked the market

I’m sure that’s why they put all the MBS stuff in the HTM pile. Assuming that there aren’t (m)any defaults it would have been a decent solution if there wasn’t a huge demand for withdrawals

I expect their startup loans etc. are doing reasonably fine. They clearly didn’t chuck lots of the new money into loans which suggests to me that they continued to do reasonable due diligence on the loans they did make.

Interest rate hedging is a thing. https://www.accaglobal.com/gb/en/student/exam-support-resources/fundamentals-exams-study-resources/f9/technical-articles/hedging.html

yes, hedging was possible, but they didn’t do it..However, WSJ now reports that there were acceptable buyers for SVB, but Biden Admin radicals insisted on nationalizing it so they could bail out Democrat Party donors…While Signature Bank was NOT insolvent, but Feds wanted to close it because Signature supported crypto….and blame it all on Trump…

Speaking of which:

https://www.bizpacreview.com/2023/03/15/tarlov-says-svb-bank-was-basically-a-maga-bank-not-a-woke-bank-cites-trump-donor-1340882

“Speaking on Fox News’s “The Five,” liberal Jessica Tarlov cited billionaire conservative Peter Thiel’s influence at SVB as proof.

“Peter Thiel was one of the top five biggest VCs there. Huge backer of Donald Trump, 2016, 2020. In 2022, he resigned from the board of META. He was one of the original board members so that he could back J.D. Vance, to join a Trump-aligned PAC for J.D. Vance and Blake Masters,” she said.

“It basically was [a MAGA bank],” she added.

As for all the “woke” activity that’d been seen at SVB, Tarlov bizarrely attributed that to the company’s white employees.”

Top quality fertilizer, fresh from the horse.

This is by-far the best explanation of this event I have read. World class, Francis.

Having read it, I have two thoughts. First, this is very far outside my area of ability and training. I can understand the explanation, but not well enough to make predictions based on it. I’m along for the ride, really.

Second, the people running it also appear to be in over their heads and just along for the ride. Or worse, they do understand it all, knew this would happen, and did it deliberately. My best-case scenario here is woeful incompetence.

So today I’ll be looking at my deposits in various places with an eye to those places defaulting, and see what I can see. It is my suspicion that Canada does not have five Big Banks, it only has one and they pretend by calling it five names.

I almost wonder if the reason it took them so long to find a risk manager and they ended up with an intersectionality hire is every competent risk manager they talked to took a look at the situation and decided not to be the one holding that bag?

Who knows? No doubt that will be covered in future court cases.

I am concerned that there seems to be a shortage of people able to do the “real” work of financial institutions, i.e. accountants and risk managers. It’s not as glamorous as holding conferences about World Equity, but it’s essential.

FTX seems not to have had accountants, or if they did, they didn’t trust them. (Probably the inner circle, the children of Ivy+ professors, didn’t have any accountant friends.) Credit Suisse seems to have been failing in the risk management department (Wirecard, Greensill, etc.) SVB.

Although I will say that much of the persiflage about diversity and such would have been done (I assume) by the marketing department, so for the Risk Management person at SVB it could well have been “sign here, and pose for the pictures,” with the marketing and organizing work done by specialist staffers.

I am concerned about signs of an….emerging incompetent aristocracy. They’re traders and entrepreneurs–but not accountants. They get paid very well for board service, but don’t seem to do actual board work. (It would be interesting to see if they all attended all meetings, served on committees, and read all materials.) Flashy, with all the right shibboleths on their lips, but no clue about standard business practices.

Most likely, FTX was governed the way it was as a result of originally being envisioned as a criminal conspiracy, one that had ties to the wider Democrat criminal conspiracy.

Sort of like the government, in other words. They recite all the ‘correct’ slogans and buzzwords without a thought of their own.

The SVB risk management officer was busy putting up social media posts about DIE stuff. So even if not intended as a diversity hire, it functionally was.

There’s a reason why Fred, the Vampire Accountant, gained a lot of friends among paranormals, even though he’s — shudder — a vampire.

The Reader thinks this should be required reading for all corporate board members. https://www.amazon.com/Do-Work-Overcome-Resistance-Your/dp/1936891379

I might quibble here and there but agree this was a great article. The only real quibble is that the government didn’t make them triple their deposits and certainly didn’t make them so concentrated in a few issuers.

I’d also say that We really give the government too much credit and the operation of the real economy too little It’s not at all clear to me that the low LT rates were caused by the Fed. I think the Fed is mostly talk and magic. And I don’t believe in magic.

Still. A great article. Much better than I could have done

C4c

Thanks for the summary

Very interesting and much more understandable than anything else I have read about this.

It makes me feel a little more calm about everything else to see what is different about this bank than the other banks that haven’t failed. Yet.

I just want to say how grateful I am to have found this place where so much really helpful information is so freely shared.

Thank you very much to our dear hostess and to all the commenters here who inform and shore up the spirit with information and entertainment. What a great place this is!

You might have also noted that the 2008 financial crunch was caused in large part by the government. Clinton’s 1998 changes to the ‘Community Reinvestment Act’ forced banks to write dodgy adjustable mortgages to unqualified borrowers in ‘disadvantaged neighborhoods’ which artificially increased demand for properties and sent prices zooming up. When those rising prices became unsustainable and new buyers couldn’t afford to get into the market, the balloon popped.

And then the bastages turned right around and blamed… the folks who tried to get reforms into the mix.

Denying mortgages to ‘disadvantaged minorities’ just because they would never be able to pay them back was RRRAAACISSST!!!

So in 2007 those dodgy mortgages started going into default. The government ‘helped’ all those ‘disadvantaged persons’ right into foreclosure. Properties were dumped onto the market in job lots just as demand was decreasing. The price spiral collapsed.

Banks are required to keep a small portion on deposit with the Fed. It earns interest. Deposits over that also earn interest, somewhat less, but around 1.5% recently. Why not park much extra there at the Fed, or start moving it there when rates started jumping?

Oh wait. Risk officer was absent or chasing unicorn farts. Right. Steady as she unsinkably goes in the iceberg zone.

Also noteworthy, “hmmmmmmm”, is how very many startups from China had money in SVB.

Whose panic was addressed?

Rather than simply guarantee all the deposits, I would like to have seen the government convert the bank’s asset securities into something like bond funds, and give their shares to the uninsured depositors. Those who could hold long-term would take little loss. Those who could not would take a haircut, but it would match the economy. And the depositors could choose how much to take now and how much to hold. Ideally the shares would be openly negotiable, like ETFs.

Anyone care to discuss this idea?

Interesting idea. There is no reason the bank could not do that, itself (as part of bankruptcy or whatever). It’s certainly more legitimate than “the statutory limit is $250,000, but we’ll do as we please.”

It also reduces the propagation of risk, especially if the ETFs or whatever have an open market. And the tranch that is pure Treasury securities should be redeemable at any time, at mark-to-market value, as part of the depositor protection.

SVB went NINE months without a chief financial risk officer. Nine months. They were more concerned with being social justice warriors than sound financial practices. A well run bank would manage the fiscal chaos and imposed losses engineered by government idiocy and malfeasance.

As on columnist noted, SVB’s risk management plan was to get Biden elected. Of course the rampant spending he and his fellow socialists rammed through fueled the entire liquidity problem to begin with.

So the lockdown madness was funded by the government, which pushed some new financial instruments into the market. Those instruments proved bad.

Lockdown funding ‘profits’ went into the government bonds which the government used to justify the lockdown funding.

Some of the funding profits was 5% of total funding, and wound up in the 16th largest bank. This bank bought the instruments, and was not big enough to cover the losses when the instruments proved to be bad.

So, one, that makes SVB look like it was a bank for the private side of the public-private partnerships that the communists have pushed. (Communists use the term ‘capitalism’ when demonizing this behavior, but fascism is at least as appropriate. All powerful regulators can pick and choose winners, can drive out smaller organizations and start ups, and can require that the large firms arrange to buy influence with the bureaucracies or the politicians. )

Two, the ‘profits’ on the spending were likely not 100%, so we are almost certainly /not/ looking at 19 other banks with 5% each. The remaining ‘profit’ in floating around in the banks is probably not as concentrated wrt size,a nd places to put it. So it may be less into bad instruments.

Three, this is a reminder that the lockdown was a massive ‘fuck you’ to quite a lot of the economy.

Four, there probably is an underlying systemic risk, but given what we know, it may be small.

Five, this seems like a significant bit of evidence against pop Keynsism.

c4c

Keep also on mind that SVB also had a fairly unique depositor pool in that substantial all of its customers were VCs, VC-funded startups, and companies that had (relatively) recently IPOed. This lack of diversification in their depositor pool also increased risk of runs, especially as the VC and IPO markets cooled. From what I’ve read the also made no attempt to hedge some of their interest rate risk.

From the perspective of borrowing against (note not selling back to the feds) the face value of their treasury notes instead of the current value — this isn’t intended to help SVB specifically but couple led with the announcement that the feds are going to ignore FDIC limits, is intended to calm depositors in other banks and try to prevent more runs.

“Keep also on mind that SVB also had a fairly unique depositor pool in that substantial all of its customers were VCs, VC-funded startups, and companies that had (relatively) recently IPOed. ”

And Signature Bank in New York, which also failed this weekend, was almost exclusively in the cryptocurrency market.

very educational, thank you!

Shocked face yadda yadda.

Legal schmegal. Gavin Newsom is Connected.

All of a failed bank’s executroids should be sacked, fined into penury, and prohibited from ever holding a position in finance again. They definitely shouldn’t be rewarded with our tax money and shuffled into another high-paying sinecure.

Maybe then they’d pay attention.

THIS!

Our guest blogger concluded an excellent presentation by Saying, “My expectation is that we may see a few more banks in trouble but probably not the sort of widespread issues we saw in 2008.”

I hope this is correct but i bought 50 grams of gold today, just in case.

Our guest blogger concluded an excellent presentation by Saying, “My expectation is that we may see a few more banks in trouble but probably not the sort of widespread issues we saw in 2008.”

I hope this is correct but i bought 50 grams of gold today, just in case.

Yeah well I may have been optimistic. Moody’s finally downgraded the entire banking system (https://www.foxbusiness.com/markets/moodys-downgrades-u-s-banking-systems-outlook-negative-bank-runs ) because it looks like SVB was not the only place that “experienced “significant excess deposit creation” thanks to a combination of pandemic related stimulus after more than a decade of ultralow interest rates and quantitative easing by the Federal Reserve.”

Apparently quite a lot of people are gradually reducing their bank deposits or as we say in plain English as in using their rainy day funds to pay for groceries and as the image in the comment below points out there are a LOT of unrealized losses in the banking system.

I’m not a financial analyst, not do I play one on TV or the Internet, but it took me about 10 minutes to scan through SVB’s regulatory filings and see the problem, and also see that the problem had been documented for months. I would have thought people at Moody’s and the rest of Wall St who are paid to do this sort of thing could have done it 6 months ago

If Moody’s downgraded it, we’re almost certainly closer to the end than the beginning.

End of what, is the question.

That which cannot go on forever, one presumes.

Six months ago was probably just prior to the legislative election.

OK so to follow up. There’s this graph making the rounds

As I mentioned regarding SVB the unrealized losses were documented at least 6 months ago possibly more. The same goes for all the other banks and their losses.

The question that should be on everyone’s lips is why did no one in authority say anything 6-9 months ago? and why were none of the credit ratings agencies and broker financial analysts not warning/downgrading? Maybe the just expected the Fed to bail the banks all out? which (spoiler alert) they have now done

Some people seem to have been aware before the run. But TPTB will tell you that runs don’t happen unless the public at large thinks that there’s about to be a run (while they haven’t said such regarding the SVB run afaik, iirc that was the Administration’s logic regarding recessions). According to that line of thinking, if you simply don’t tell the public that the bank is weak, there won’t be a run – even if the bank actually is weak.

The basic answer is that all US treasuries sell at par at maturity. the banks can always hold them to maturity so long as they manage the interest rate risk in their book to cover their liabilities. if they’re unlucky, they’ll make less money than they could have, if they’re lucky the rates will go down, which will probably happen as the recession hits, and they’ll look good. SIVB didn’t do that, they decided to roll them into held for sale and take the loss. Why? I have no idea,

I can’t think of another bank that’d decided that now would be a good time to roll over their entire investment portfolio, have management sell their shares in size, and have such concentrated liabilities. On top of that, they don’t seem to have had anyone on staff who could interpret a simple gap report, never mind anything more complicated. It was a perfect storm.

Why SIVB went under I’m pretty sure I understand, why Signature went under and all the rest I really can’t fathom beyond the observation that panic causes people to do stupid things, in a word Contagion.

As for why the regulators didn’t notice, well to notice you have to look and know what to look for and the basic fact is that few people under 60 have direct experience of existential interest rate risk, I mean, SIVB assets were all Treasuries, Agency, and well collateralized corporate loans. How much trouble could one get into?

Right. If banks could hold their securities all to maturity they would not be out of the money. But that assumed that their depositors didn’t start on average withdrawing money so that they had less.

My guess is that thanks to all the inflation etc. a lot of people are seeing their bank accounts gradually decline in dollars because they are spending more than they get in.

That means that banks have to provide them with cash and therefore they may need to liquidate some of these under water securities.

BTW this article (https://www.bitsaboutmoney.com/archive/banking-in-very-uncertain-times/ ) quotes a very useful law about how to figure out changes in bond values based on interest rates:

Every bond and instrument created on top of bonds has a “duration”, which you can round to “how much time left in years until we expect this to be paid back?” And every bond and instrument on top of bonds has its market price move down by 1% per year of duration if interest rates move up 1%, and vice versa. […]

So if you held ten year bonds and interest rates went up 4% in a year, your ten year bonds are down, hmm, somewhere in the 35%ish range

It depends. SIVB was unique. BofA, which has a lot of this, is very different. The biggest thing is that one depositor could have been enough to cause a run on SIVB. Their concentration risk was absurd.

All this sort of stuff did happen in the 70’s, which is why we don’t have mutual savings banks anymore. Still, you can match fund your liabilities without selling your whole damned book at once. People,do, they’re doing it right now.

My understanding on Signature is that they were essentially all crypto, the modern day Tulip Bulb.

That was what Frank was saying, and he would have likely been in a position to know.

I’m just not seeing it. Other than burning through a lot of cash last year, on the face of it, it’s not a bad balance sheet. Certainly not the Crypto fiend the press has them as. They look like a garden variety regional bank, better than some in fact. I’m holding to panic and contagion as an explanation unless and until someone can point me to the facts that made this a bad bank.

I’d appreciate if someone could point me to where this crypto is supposed to be because I just don’t see it. I’m using their 10k.

Barney Frank has publicly stated that they had a lot of crypto. So it seems fair to believe that such was the case.

He’s also been saying that the bank shouldn’t have been closed down, and that it might have been targeted by the Feds specifically because it’s heavily involved with crypto companies. But if true, that would absolve him of any blame for the collapse of the bank, and should probably be taken with a grain of salt.

Yeah I didn’t see any either. Unless it’s hidden in some other asset and not clearly broken out

The only place it can be hiding is in “Commercial & Industrial loans” specifically one of Fund banking ($27B so most likely), Specialty finance ($6.7B) or Other commercial and industrial ($6.1B) but I don’t see how it gets classed as any of that

I found it, in deposits. They had cash deposits from crypto connected entities. There was no crypto per se that I could see on the balance sheet. They had been cutting their exposure to it substantially over the last 6 months or so. It’s still bizarre. Best I can figure is that the run off in deposits, which was real and substantial but their doing not a run, was interpreted as a run. Bad luck and contagion mostly.

Today is Credit Suisse day. I know why they’re in trouble. The usual thing.

Which tells us where at least some of the money that disappears in the crypto “hack of the day” probably came from.

So, ironically SVB is not a total s**tshow, it just can’t deal with the Biden economy any better than normal people. And some strange banking regulations that require that if your bank has money it MUST lend it. I kind of boggled at this one. And BTW raise your hand if you knew that the fractional reserve got dropped to 0 in 2020 which sure didn’t help SVB and probably others coming up.

One final personal note. It’s going to be harder for individuals to do runs on banks when the very next paycheck gets autodeposited to the bank they just ran on.

Thanks Francis!

I think Turner explained it quite well but Tucker Carlson ‘splained it better; https://youtu.be/_1g3I9qyvF8

Francis: “Lots of small businesses applied for [pandemic] grants and got them and banked much of the money because they didn’t need to spend it all at the time. …It looks like SVB basically got about 5% of all US Wuflu subsidy spending deposited in it in 2020 and 2021.”

So: the money that Biden has promised that the depositors will get somehow back from FDIC (which we know means taxpayers will provide it through one means or another) is money that they got from the taxpayers in the first place.

WHY? — instead of Biden Inc. just saying, “If you didn’t need it when we gave it to you, you don’t get it back now.”

Of course we all know the answer: many SVB depositors are their buddies, even if they are evil rich capitalists who aren’t paying their fair share.

And never will.

@ Almuric a few comments back: “Gavin Newsom failed to disclose personal ties including his bank accounts at Silicon Valley Bank while lobbying for their bailout.”

Everybody’s talking about SVB – interesting post linked by commenter at Neo’s place today on the Open Thread (link omitted to not trip the hall monitor).

physicsguy on March 14, 2023 at 2:47 pm said:

…. Looks like SVB was even more bizarre than previously noted. Well, maybe not, given the “woke” track record of a lot of corporations today.

https://www.dailymail.co.uk/news/article-11859379/Only-ONE-member-failed-SVBs-board-experience-investment-banking.html

Another interesting – or scary – revelation; no link provided so I can’t vouch for it but it sounds Too Good To Check.

TommyJay on March 14, 2023 at 5:59 pm said:

The Biden admin. says that taxpayers won’t pay the burden of bailing out SVB depositors because they will be paid out of FDIC capital.

Today I heard that the FDIC’s capital is in the same underwater long maturity Treasuries that caused some of SVB’s problems in the first place. I guess the FDIC won’t be holding their portfolio to maturity either.

I just wanted to let you know I appreciate your very well written and illuminating essay. It is also a delight to find so much meaningful discussion in the comments; its an awesome community here. – I lurk- rarely to never comment- but thought you should get some feedback on this. Thank you SAH, for making the space.

This was a much better explanation of the wht than you’re probably going to see in the MSM, let alone from the government.

The proposed solution: “The government (treasury, federal reserve, SEC etc.) have announced that they will redeem government securities at par value thus removing the losses caused by their 20% or so fall in value over the last year.” looks plausible at first glance.

What are the bank that are supposed to be obediently sitting on all these non performing assets supposed to use to generate the money to pay interest rates on deposits to keep them from going someplace that will? What’s to keep the banks from cashing out at par to reinvest at market rate? And then do it again and again as rates explode? What about all the other suckers stuck with these worthless pieces of paper? What about the person with the underlying mortgage on a house now worth a fraction of the balance?

This is like a perpetual motion machine that looks great until you try to drive a load, then the fraud appears for all to see. I sure don’t know what a good answer is, but I know smoke and mirrors when I see them. We’re all about to find out how many zeros will fit on a Starbucks receipt.

Francis or BGE, what’s your opinion on this (via Insty):

https://www.realclearpolitics.com/video/2023/03/15/former_treasury_official_bailout_is_in_the_eye_of_the_beholder_but_biden_is_effectively_nationalizing_the_banks.html

The summation of the video is this:

Emphasis added.

“Because you can’t guarantee all the deposits in Silicon Valley Bank and then the next day say to the depositors, say at First Republic, sorry, yours aren’t guaranteed. Of course, they are.”

I know I entirely disagree with that sentence. They’ll tell any non-woke bank servicing deplorables exactly that in a heartbeat.

I realize I’m late to the party and this is sort of overtaken by events, but…

There was never ANY chance that this was an isolated problem.

We are early in the deflating stages of the “everything bubble”, meaning virtually asset that is frequently bought with borrowed money is vastly overvalued and is coming down pretty fast.

This includes real estate, bonds, and stocks.

These are the foundational assets of this civilization so when they are misvalued bad things happen.

We are seeing what happens when they start to return to their actual values.

There is much more to go on the downside. Hold on tight!